Join Blockchainexplained to learn “The Bitcoin money supply equation, The math behind the Bitcoin halving, How to calculate the approximate time between Bitcoin halving events? Potential impact of Bitcoin halvings on cryptocurrency adoption” through the article below.

Related: Can blockchain-based location mapping replace GPS mapping?

The role of halving events in Bitcoin’s scarcity mechanism and inflation control

A key component of Bitcoin’s design is its periodic halving, which ensures the cryptocurrency’s scarcity and acts as a buffer against inflationary pressures.

Bitcoin halvings, which are programmed into Bitcoin’s code, occur about every four years. The block reward is halved with each halving event, and the supply of new Bitcoin (BTC) is directly impacted.

Additionally, halvings add to the intrinsic scarcity of Bitcoin by steadily lowering the rate at which new BTC enters the market. Its predictable and limited supply, which is capped at 21 million coins, supports Bitcoin’s long-term value proposition.

Halvings also reduce inflation by gradually decreasing the supply of new Bitcoin. This predictable inflation control mechanism makes Bitcoin a desirable alternative to conventional fiat currencies, which are vulnerable to unpredictable inflation.

The Bitcoin money supply equation

The Bitcoin money supply equation formula provides a theoretical maximum supply. In reality, some early mined BTC might be lost, resulting in a slightly lower circulating supply.

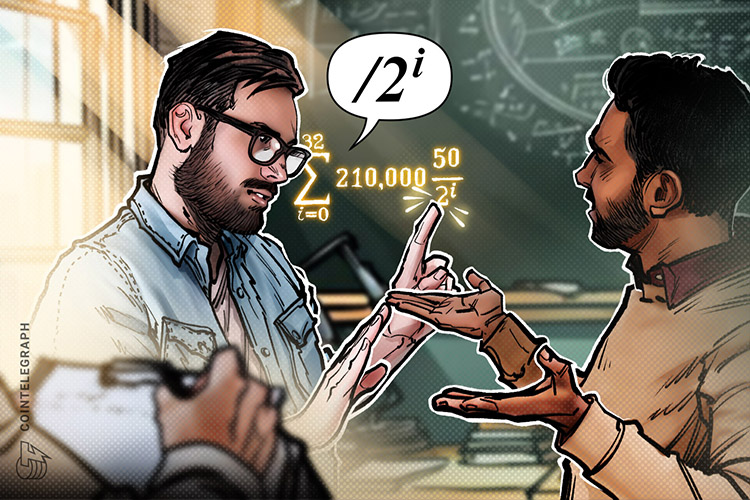

The Bitcoin money supply equation formula can be seen in the image below:

In the above equation, Σ (Sigma) refers to summing up the Bitcoin block rewards across all halving cycles.

- i: An index variable that represents each halving cycle.

- 0: The summation’s starting point represents the first (genesis) block.

- i=0^32: This defines the range of the summation.

- ^32: The summation’s upper limit, indicating the 32nd halving cycle. Since counting starts from 0, this includes a total of 33 halving cycles (0 to 32).

- 50: This is the genesis block’s initial block reward (50 BTC).

(1/2)^ (i/210000)): This represents the block reward for each halving cycle.

- (1/2): This represents the halving factor, where each reward is divided by two at each halving event. This is why it’s raised to the power of -1 (1/2 is equivalent to two raised to the power of -1).

- (i/210000): This exponent accounts for the number of halving cycles that have occurred. As ‘i’ increases with each cycle (from 0 to 32), the exponent ensures the reward is halved at the appropriate intervals (roughly every four years).

The math behind the Bitcoin halving

A few core concepts like the block reward, halving equation and exponential decay form the basis for the mathematical foundation of Bitcoin halving.

The Bitcoin halving math is an interesting example of how code can enforce economic principles. The idea primarily centers on the block reward, which is the quantity of freshly produced BTC that miners are awarded for successfully validating transactions and adding a new block to the blockchain. This block reward was initially set at 50 BTC in the Bitcoin design, and it is consistently halved roughly every four years.

A straightforward yet effective equation controls this reduction:

Block reward: 50 / 2^(blocks/210,000), where “blocks” is the total number of blocks mined since the inception of Bitcoin.

This equation’s exponential nature is what makes it magical. The block reward diminishes exponentially with every 210,000 blocks added to the blockchain. Accordingly, the reward was lowered to 25 BTC after the first halving, 12.5 BTC after the second and so on. This programmed deterioration replicates the growing complexity of precious metal mining, where resource extraction becomes more expensive and complicated with time.

The halving mechanism of Bitcoin has significant ramifications. It introduces built-in scarcity by gradually lowering the pace at which new Bitcoin enters circulation. Moreover, Bitcoin’s potential as a store of wealth is bolstered by its limited supply and predictable nature.

How to calculate the approximate time between Bitcoin halving events

The exact timing of a Bitcoin halving cannot be predicted with precision, however, one can make a rough estimate.

Bitcoin’s code is designed to generate a block every 10 minutes. Since halvings occur every 210,000 blocks (not after a specified time or date), the following basic calculation may provide a preliminary estimate: 210,000 blocks * 10 minutes/block = 2,100,000 minutes.

Divide the total minutes by the number of minutes in a year to obtain a number in terms of years: 2,100,000 minutes/(365 days a year * 24 hours a day * 60 minutes per hour) = approximately four years.

In reality, the intervals between halvings may differ from this four-year average because the production rate of blocks is not precisely fixed at 10 minutes. Variations in the overall hash rate (computational power) of the network can also cause the process to slightly speed up or slow down.

Potential impact of Bitcoin halvings on cryptocurrency adoption

Anticipation around halving events can increase demand for Bitcoin, potentially attracting new investors and boosting its visibility.

The cryptocurrency community may feel a sense of urgency and anticipation as a result of the halving. Around halving events, this increased attention frequently results in higher demand for Bitcoin and possible price swings.

Such market activity may pique people’s interest in Bitcoin and cryptocurrencies and raise public awareness of them, which could lead to increased adoption. Although the halving’s direct effect on price is speculative, BTC’s overall value proposition is strengthened within the evolving landscape of digital assets due to its role in highlighting its unique economic design.

Moreover, the emphasis on limited supply, controlled inflation and scarcity strengthens Bitcoin’s appeal as a competitive alternative to fiat currencies and other cryptocurrencies, potentially attracting a wider range of individual and institutional investors.

Source: Cointelegraph.com

Tải hình ảnh miễn phí

x